Inspiration:

Core Values:

Background

Vision:

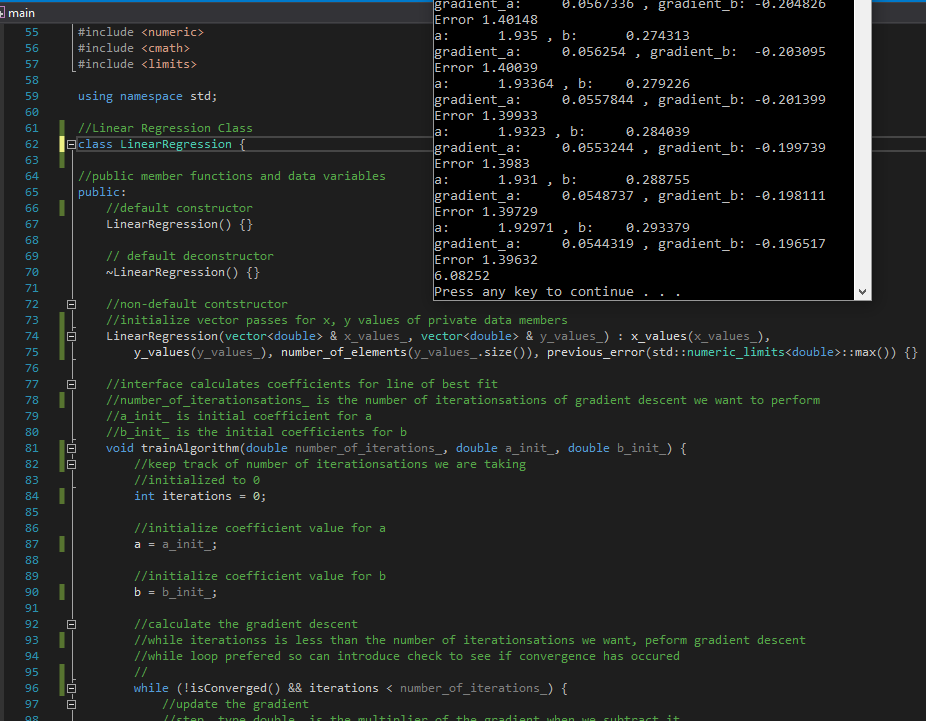

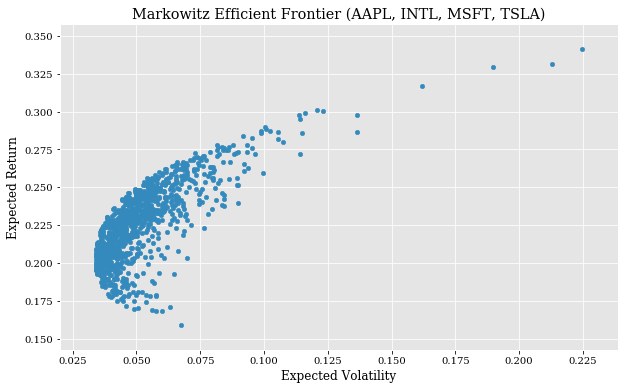

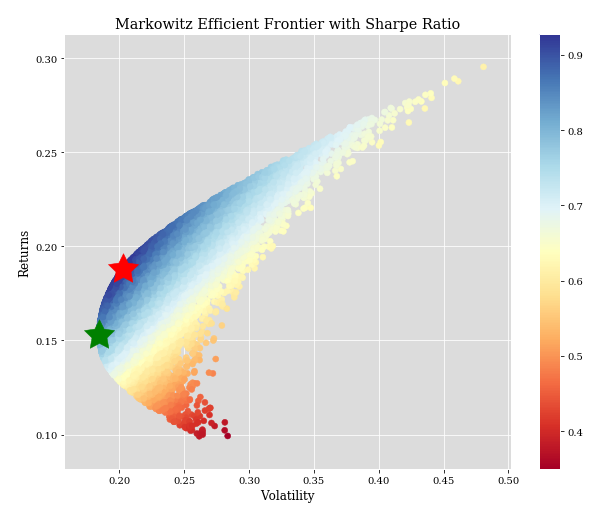

Interests include: Systems engineering, data science, deep learning, machine learning, computational modeling/simulation, telecommunications/networking engineering, expert decision support systems, optimization/automation, sensing systems, cyber-physical security, agricultural automation, and high performance computing.